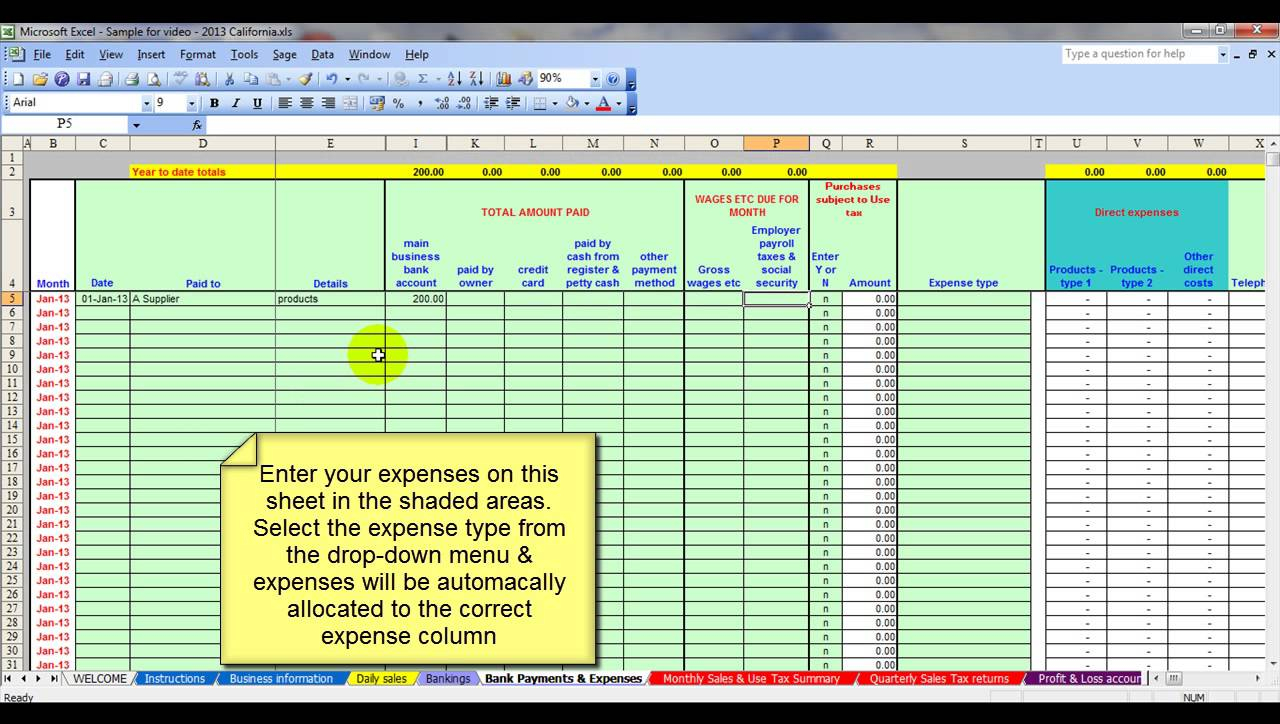

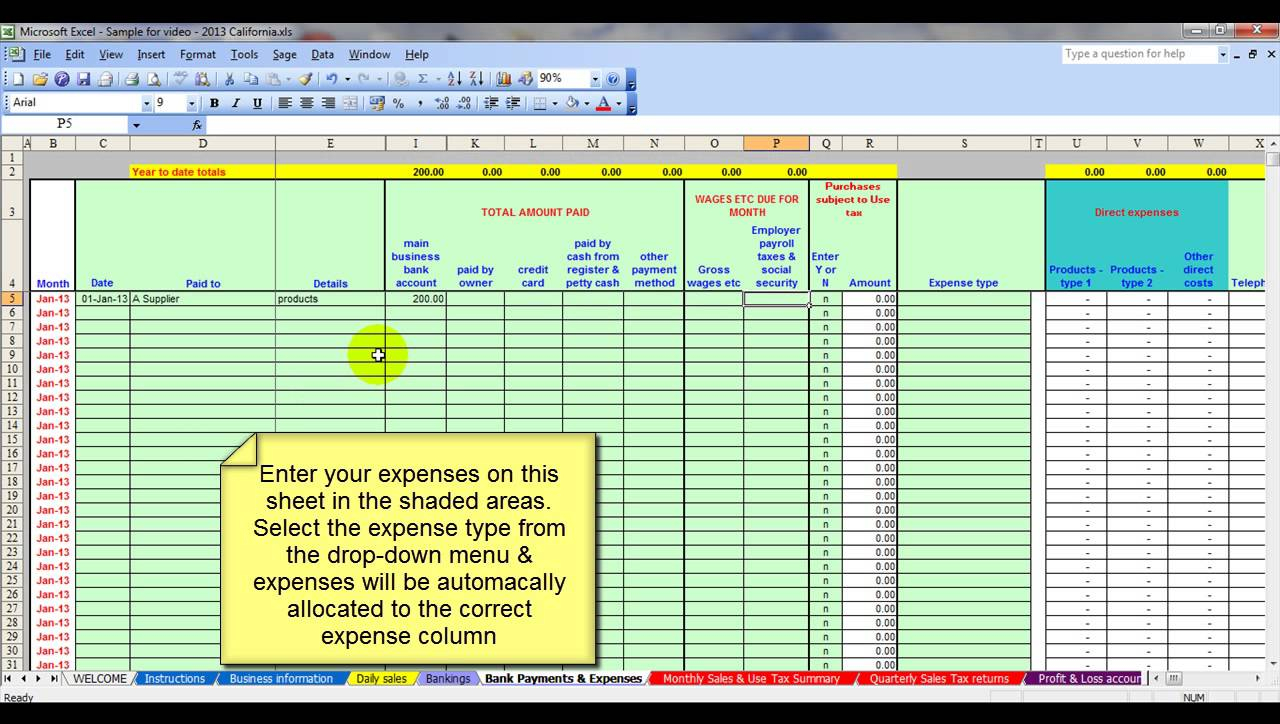

Monitor Your Transactions on a Weekly and Monthly Basis. Invest Time in Understanding Bookkeeping Basics. In the meantime it's worth researching different bookkeeping softwares that can help you streamline your bookkeeping process and prepare financial reports.Below are 17 small business bookkeeping tips to guide you along your bookkeeping adventure Contents Ideally, you'll reach a point where you can hire an accountant to help you manage your business finances. These three steps are a great place to start but as your business grows, you'll want to further flesh out your bookkeeping process. It also shows what the business's earnings and spending is, as well as how much cash is immediately available to pay bills. Cash flow statement: The cash flow statement is similar to the P&L statement, but it excludes non-cash items such as depreciation. Profit and loss (P&L) statement: The profit and loss (P&L) statement, also known as an income statement, illustrates the business's revenues, costs, and expenses over a certain period of time, and is used to compare sales and expenses, as well as make forecasts. Balance sheet: The balance sheet is a document that summarizes a business's assets, liabilities, equity at a single point in time and showing the current health of the business andits ability to expand or reserve cash. These are three helpful reports to start with: To better understand your business's financial health, you can create various financial reports. Understanding how money flows in and out of your different accounts can help you gain valuable insight into the health of your business and will lead to making more informed decisions regarding how you operate your business. Make it a habit to record any of the following events at least once a week (or ideally, the same day they occur): The less rigorous you are about your record keeping, the harder it will be to manage it, and it will be easier to let income and expenses slip through the cracks. The key to making bookkeeping a seamless process is to keep up with it. When dealing with bookkeeping, accounts don't refer to bank accounts they're simply categories that organize certain financial transactions. Speaking of accounts, you need to set up the right small business accounts to properly manage your business ledger. Making double entries gives you a second opportunity to catch any mistakes. With the double-entry method, you make two entries for every transaction in two different accounts for example, your cash and equipment account if you purchased a piece of equipment. Double-entry: The double-entry method is more work but will help you avoid bookkeeping mistakes, which is why it's usually the better bet if you have to manage many different transactions a month. The single-entry process is a good fit for sole-proprietors or freelancers who only have one to two business transactions a month. Single-entry: With this method, you will record every single financial transaction a singletime in your overall bookkeeping record. There are two popular methods that most small businesses turn to: One way to make your bookkeeping process easier is to choose the method that works for you. Keep reading for more insight into the basics of small business bookkeeping.

Knowing the ins and outs of your cash flow can help you make more informed decisions that can help you grow your business.Īdditionally, staying on top of your bookkeeping will come in handy during tax season when you need to provide detailed information about your profits and spending.

Having a good small business bookkeeping process is necessary to understand where your revenue is coming from, what you're spending money on, and what areas of your business are most profitable. Running a small business involves wearing many different hats, and one that you need to get comfortable wearing if you want your business to succeed is the accounting hat.

0 kommentar(er)

0 kommentar(er)